When was the last time you decided to visit a physical store instead of one online? Every time you entered a physical store, you had to remember the brand you were accustomed to. But things have significantly changed in the current environment, particularly in the wake of the pandemic. The importance of online shopping today cannot be overstated.

And now that you can shop online, you can benefit from credit cards. Sometimes, credit cards are considered quite expensive due to their higher credit points or other perks. However, these can be useful if used responsibly, and bills are paid on time. You can easily go to any online or offline store and make a purchase with a credit card. Cashless transactions are the best benefit of credit cards.

With a credit card, you can make purchases without using cash and get access to fantastic rewards programs and other benefits. Here, you can learn about benefits of credit cards here.

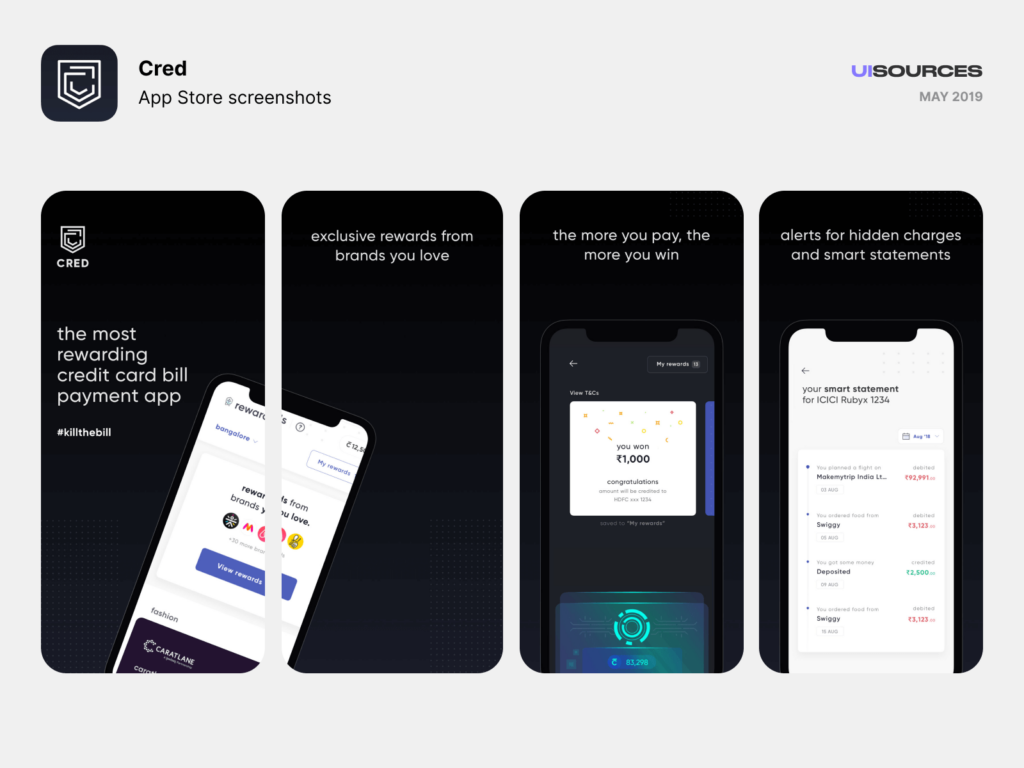

- Credit cards have used loyalty programs since they first came to the market to reward users like you. The majority of credit card providers have a minimum transaction threshold that must be met to qualify for reward points. You can use reward points to make purchases once you have a sufficient number. Another choice is to use coupons provided by online merchants when shopping or buying food. Additionally, you can get fantastic discounts from any send money cashback app when you complete a transaction using a premium credit card.

- Numerous sign-up bonuses from most credit cards are typically offered directly to the UPI wallet. You might get the most reward points if you apply for particular credit cards.

- You can accrue many points or miles using your credit card through the UPI QR code for daily purchases rather than cash. Using your credit card for daily purchases can maximize your rewards and reduce unnecessary spending. The reward points can be used to pay for travel or other purchases. You can also send money online via credit card to get rewards.

- The creation of numerous expensive, exclusive online marketplaces has made buying any luxury goods easier than ever. It was simpler to hand over a check or get cash from an ATM nearby when purchasing in a physical store. But nowadays, when making a purchase online, things are different. Almost all online retailers provide free EMIs via credit cards to assist you in breaking down your large purchases into smaller payments. Additionally, credit cards are compatible with every UPI payment gateway, so there won’t be any issues when making a purchase.

- You can always keep track of your expenses and all the other advantages associated with rewards. Credit cards also assist you in raising your credit score. Your credit score can facilitate quick loan approval. Credit cards, the most widely used form of payment, can also facilitate international purchases. You can purchase your preferred foreign brand products online using credit card payments.

- Credit cards may also help you to transfer money to bank account.

Types of credit cards:

- Reward credit card: Point-based credit cards are reward credit cards where points can be redeemed for future purchases through various transfer money app.

- Cash back credit card: Cash-back cards offer greater cash back on each purchase of food, groceries, electronics, and other things like money transfer.

- Travel credit card: Travel credit cards are the best way to finance a dream vacation for ardent travelers.

- Business credit card: Business credit cards are preferable for segregating personal and professional expenses

- Student credit card: Student credit cards are created especially for students to pay for their tuition, books, and other educational expenses.

Credit cards are known worldwide for their countless advantages. Additionally, many UPI apps today offer credit card features that let users instantly accept the offer. You can use those rewards to get more cashback or discounts on future purchases.