Financial flexibility is critical, especially when unexpected expenses occur. A credit line is a handy borrowing alternative whereby you may get money whenever required without having to reapply. Unlike conventional loans, in which you borrow a set amount and pay interest on the whole sum, a credit line allows you to withdraw just what you need and pay interest on the used amount.

- Explains a credit line

Pre-approved borrowing limits called credit lines allow you the flexibility to withdraw money as needed. Rather than applying for a lump sum loan, you can get money in smaller amounts anytime needed. This flexible borrowing approach guarantees that you pay only for what you need, so it is a reasonably affordable financial tool. It provides instant cash access free from the burden of several loan applications, so acting as a financial safety net.

- Why might a credit line be preferable than conventional loans?

More often than conventional loans, a credit line offers a hassle-free borrowing experience. One approval process guarantees continuous access to funds, therefore removing the need for you to reapply each time you need money. Unlike conventional loans, where you could find yourself borrowing more than necessary, a credit line guarantees you utilize just what is needed, therefore lowering needless interest charges. Additionally flexible is the repayment schedule, which lets you pay back in installments determined by your circumstances.

- Quick Financial Relief with Instant Money Loans

Should you not have a credit line, an instant money loan might be a fantastic substitute. Designed for crises, an immediate money loan offers fast cash with few papers and speedy approvals. These loans are handled in minutes so you get money without needless delays. Whether it’s a last-minute payment, an unforeseen cost, or a medical emergency, a quick money loan guarantees the financial help you need without waiting for drawn-out approval procedures.

- Borrow Anywhere, Anytime with the Quick Loan App

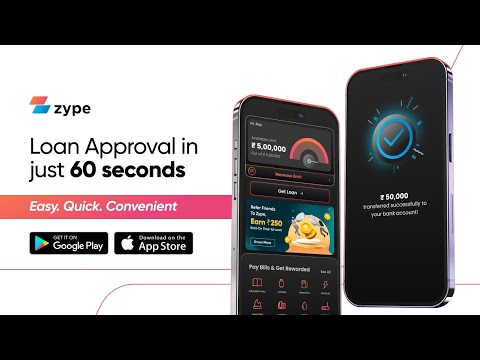

Rising digital banking services have made borrowing simpler than ever. Users of a rapid loan app may apply for loans right from their cellphones, therefore saving time and avoiding bank visits. These applications guarantee quick approval, therefore ensuring that money is distributed in hours or even minutes. Those who want a flawless borrowing experience and need money quickly might find a quick loan app ideal. It is now among the most often used methods to acquire immediate credit because of its easy eligibility criteria and user-friendly interface.

- Easy, quick, hassle-free cash loan app

Another great approach to receiving quick money without following difficult processes is a cash loan app. These programs are meant to give loans simple access without calling for collateral. A cash loan app guarantees timely disbursal and various repayment alternatives whether your needs call for money for an urgent payment, travel expenses, or other unanticipated event. Applying for a loan with a few clicks will transfer money straight into your bank account, thereby simplifying and relieving the tension of borrowing.

- Advance Salary Loan, Get Paid Without Waiting

Designed especially for salaried people needing cash before payday, it is a salary loan. A salary loan lets you access some of your income ahead of time for either monthly budget management or immediate needs. This is a reasonable and controllable borrowing choice since the payback is changed in the next checks. A salary loan guarantees that financial restrictions do not interfere with your regular spending by means of swift processing and easy approval.