Financial crises can strike any moment in the fast-paced environment of today. Whether it’s a medical bill, an urgent bill, or unanticipated vacation expenses, you really must have rapid cash. This is where a quick loan helps most. Fast loans have never been more simple, thanks to technology options like a cash app. Knowing the application process and approval criteria will enable you to obtain the money you need without needless delays if you are seeking a quick loan app in Nigeria.

Describes an Instant Loan here

Designed to offer immediate access to cash without the drawn-out approval procedures of conventional banks, an instant loan is a short-term financial fix Instant loans are usually unsecured, so more people can get them than with traditional loans that call for collateral and thorough documentation. Applying for a quick loan has become more handy than ever as digital banking grows.

Why Choose an Instant Loan App Nigerian Style?

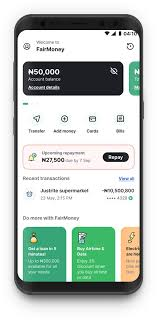

With a boom in fintech solutions, Nigeria now finds loan access simpler than ever without visiting a bank. In Nigeria, a rapid loan app lets borrowers apply, get accepted, and obtain money in minutes, therefore saving needless paperwork and waiting times.

Selecting a Cash App for Instant Loans

Choosing the best cash app for quick loans depends on the various choices at hand. Search for apps with open terms, low interest rates, quick approval timeframes, and good user comments. Strong security features of dependable programs will also help to guard your personal data.

Steps for registering on a Fast Loan App

Download the cash app from the Play Store or App Store following choice of a reliable lender. Register using your personal information like your complete name, phone number, email address, Bank Verification Number (BVN). To evaluate your capacity for repayment, certain apps could call for evidence of work or income.

Verification of Identity, Crucially Important for Approval

An instant loan app in Nigeria demands identity verification in order to guarantee security and stop fraud. You might have to validate your bank account, submit a current government-issued ID, and finish a facial recognition check. Accurate information accelerates the approval process.

Choosing Loan Terms and Amount:

Once your account is confirmed, choose the loan amount and payback term to apply for a quick loan. Many loans have flexible repayment schedules, so you may pay back weekly or monthly. Before validating your request, make sure you check the interest rates and extra fees.

Presenting Your Loan Application

Enter the required information then apply using the cash app. Many apps instantly evaluate eligibility and issue loans in minutes using artificial intelligence technologies. Make sure all the given data is accurate to prevent pointless delays.

Getting money straight into your bank account

The money from your authorized loan is directly transferred to your wallet or bank account. Certain instant loan apps available in Nigeria guarantee very instantaneous payment, so assuring that you get the money minutes of approval allow.

Advice on Boosting Loan Approval Prospects

Your chances of being approved for a quick loan will increase if you keep a strong credit record, provide accurate information, pay back past loans on schedule. Steer clear of several loan applications concurrently since this can lower your chances of approval.

Conclusion:

Managing financial crises is easy and quick if one applies for an instant loan using a cash app or rapid loan app in Nigeria. Selecting a reliable lender, doing thorough verification, and knowing loan terms can help you to rapidly approve a fast loan and get money free from stress. To create a good financial profile, always borrow sensibly and guarantee timely return-on- investment.